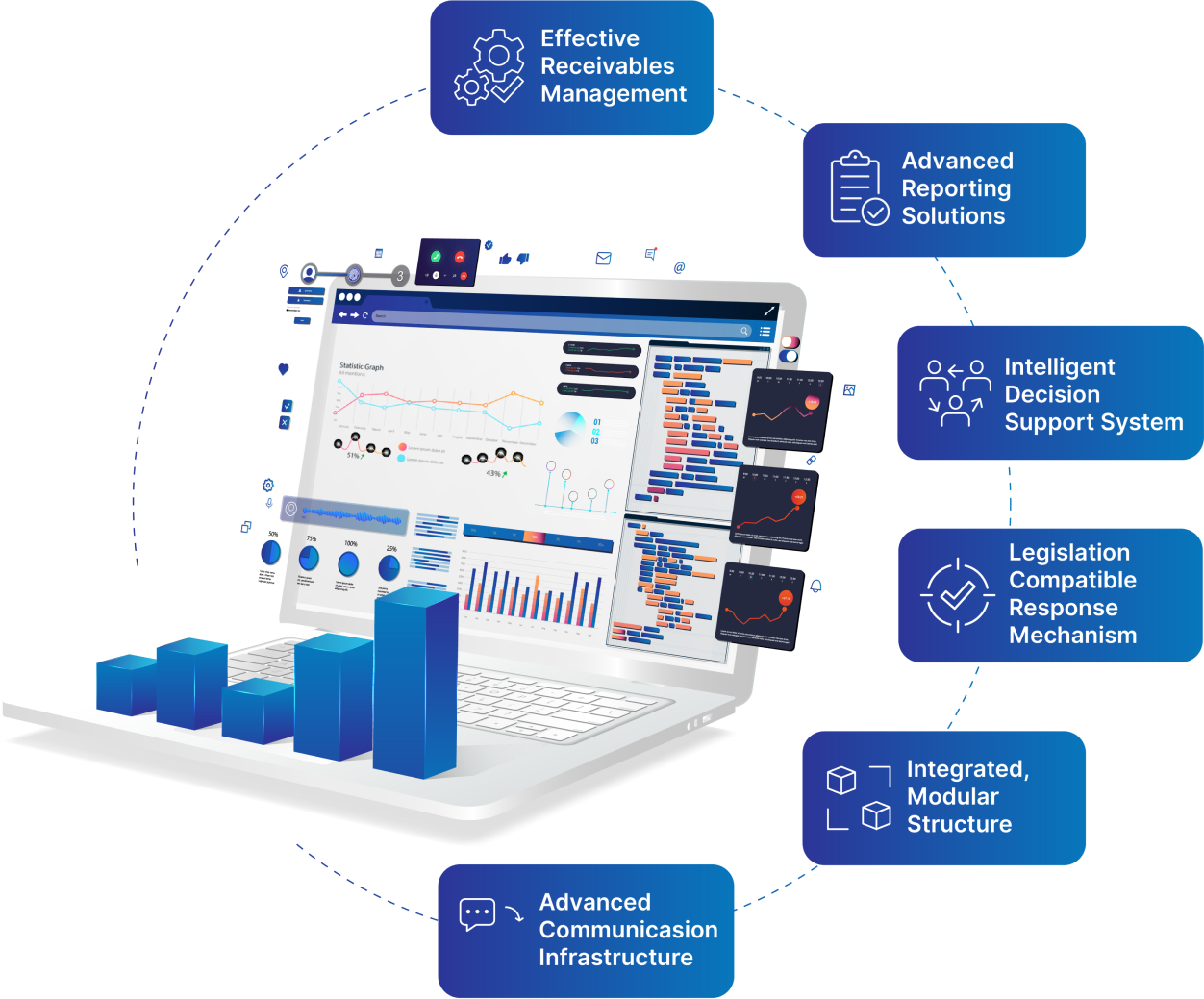

Consumer Financing System

All infrastructure needs of financing companies on a single platform!

Modules

- Customer Management

- Credit Scoring

- Allocation and Utilization

- Receivables Management

- Legal Follow-up

- Accounting

- Reporting

- Legal Integrations

- Commission and Expense Management

- Business Process Management

- Document Management

- Information Management

-

Automatic Allocation and Application Evaluation Systems

- Consumer Financing System is integrated with Automatic Allocation and Application Evaluation systems. Financing applications are accepted or rejected with intelligent decision support systems, enabling fast allocation

-

Information Infrastructure

- Thanks to the information infrastructure, information can be sent in SMS, E-Mail, Fax, Push types after the desired situations. To summarize, it is a holistic system that includes all processes from the allocation to the liquidation of financing

-

Description Based Product Identification

- Consumer Financing System; product identification, accounting, pool and price definitions can be made in a parametric manner. Product definitions also provide definition-based limit, collateral, installment options, commission and expense definitions

-

Parametric Automatic Collection System

- Effective prioritization of post-utilization receivables management and parametric management of the instant and daily automatic collection system can be easily performed through the system

-

Response Mechanism

- The system has parametrically designed provision mechanisms that comply with the legislation but can also use the institution's initiative when necessary.

-

Automatic Reporting

- Reports can be quickly transferred to the live environment by writing database queries without the need for coding. With the Report Mailer, it is possible to automatically send the desired reports to the selected users at the desired intervals

Contact us for detailed information!